Multiuser Collaboration

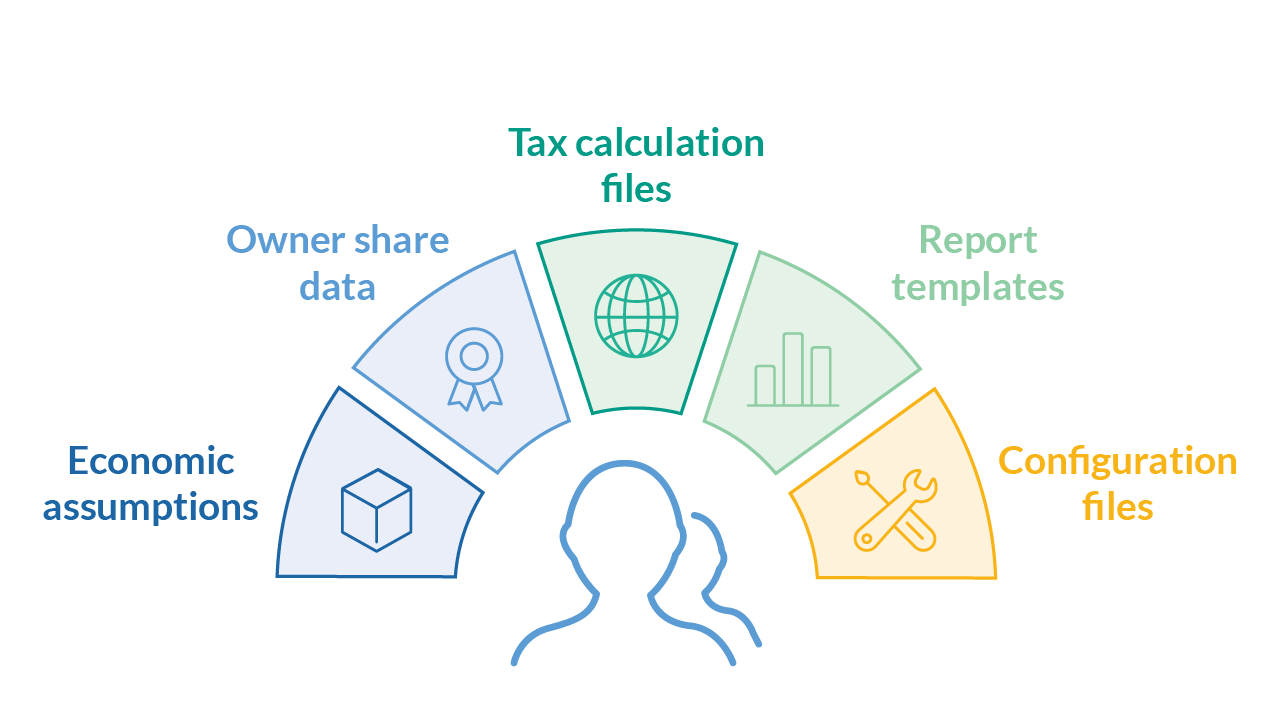

Arcast is built to ensure consistent calculations over time and between projects and users. This allows users to make head-to-head comparisons of different projects or different instances of the same project at different times. This is achieved through functionality to support versioning and sharing of:

- Economic assumptions

- Owner share data

- Tax regime calculation files

- Report templates

- Configuration files

When all calculations are performed with the same set of files, focus may be put on analyzing the results, rather than determining the differences between different calculations.